Buying a home comes with all kinds of feelings, excitement, maybe a little stress and plenty of questions. One of the most confusing? Closing costs. We get it. You’ve saved up for the down payment, maybe even picked out your countertops and new mattress, and then boom! Here comes this list of extra expenses just before settlement.

Here’s the thing: understanding what these costs are, when you’ll pay them and why they matter can make the process feel a lot less overwhelming. That’s what we’re here for. At Insight Homes, we don’t just build a better house; we build to a standard that less than 1% of builders nationwide meet as a U.S. Department of Energy Zero Energy Ready Home partner. Whether you’re building in Sussex County, Delaware or settling into life on Maryland’s Eastern Shore, knowing your numbers upfront gives you confidence that lasts long after closing day!

What Are Closing Costs, Really?

Closing costs are the final set of fees that make your home purchase official. Think of them as the finishing touches that legally and financially transfer the home from seller to buyer. They’re not random and they’re definitely not optional.

Instead, these costs serve a purpose—they protect you, verify the value of what you’re buying, and ensure everything is handled correctly from a legal standpoint. It’s not just red tape. It’s part of how you know your new home is truly yours.

What You’re Likely Paying For

Closing costs vary depending on the price of the home, your lender, your location and even your credit score. But no matter where you’re buying, here’s what you’re most likely to see on your final settlement statement—and what each one really means.

Loan Origination Fee

This is what your lender charges to process your mortgage. It covers the behind-the-scenes work like underwriting, verifying documents and making sure everything adds up.

Title Insurance

Title insurance protects you from any future disputes over who owns the home. It’s a one-time fee and while you might never use it, it could save you tens of thousands if someone ever claims they have rights to your property.

Appraisal Fee

Your lender wants to be sure the home is worth what you’re paying. So they’ll order an appraisal—a professional estimate of the home’s value. You’ll foot the bill, usually somewhere between $300 and $600 depending on your area.

Prepaid Taxes and Insurance

Here’s where timing comes into play. Depending on your closing date, you might have to prepay a few months of property taxes or homeowners insurance. It’s not an extra fee; it’s just paid early so your lender can set up your escrow account.

Escrow or Attorney Fees

Escrow companies and closing attorneys handle all the paperwork, disburse the funds and make sure nothing slips through the cracks. Their fees can range, but you’re usually looking at a few hundred to over a thousand dollars, depending on how involved the process is.

Who Pays Closing Costs—And When?

Both the buyer and the builder have roles to play here. In most cases, buyers cover the bulk of the closing costs especially the ones tied to the mortgage and title. Builders often pay agent commissions and may agree to cover a portion of the buyer’s fees.

Here’s the key: know what to expect early. Talk to your lender and builder up front so you’re not caught off guard at settlement. The builder and lender provide a fee schedule, letting you know what is due and when, well in advance of settlement day.

Why This Matters More Than You Think

It’s tempting to focus only on the price of the home or the monthly mortgage payment, but closing costs are part of the full picture of homeownership. Understanding them protects you from surprise expenses, helps you plan ahead and keeps your finances on track.

And here’s where credit score importance really comes into play. A stronger score can mean better loan terms, lower interest rates and even reduced closing costs because lenders see you as less of a risk. It’s not just about getting approved. It’s about saving real money.

You Deserve a Better Experience

Closing costs might not be the most exciting part of buying a home, but understanding them is one of the smartest moves you can make.

At Insight Homes, we believe that smarter homeownership starts with smarter choices. That means full transparency, no guesswork and support from start to finish. From energy-efficient designs to thoughtful layouts and stress-free closings, we build homes and processes that are designed around you.

Buying a home should feel exciting, not confusing. And with the proper guidance, it can be. We’re here to make sure of it. Ready to take the next step? Let’s talk.

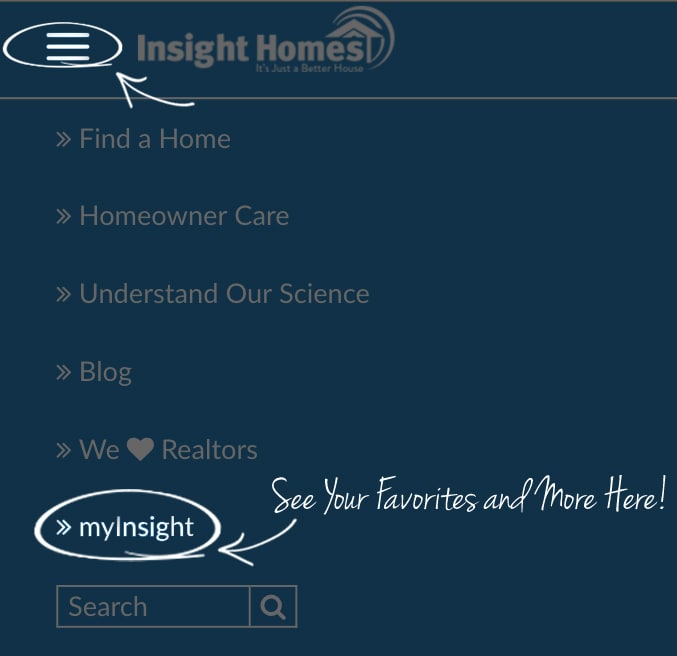

Swipe to learn more

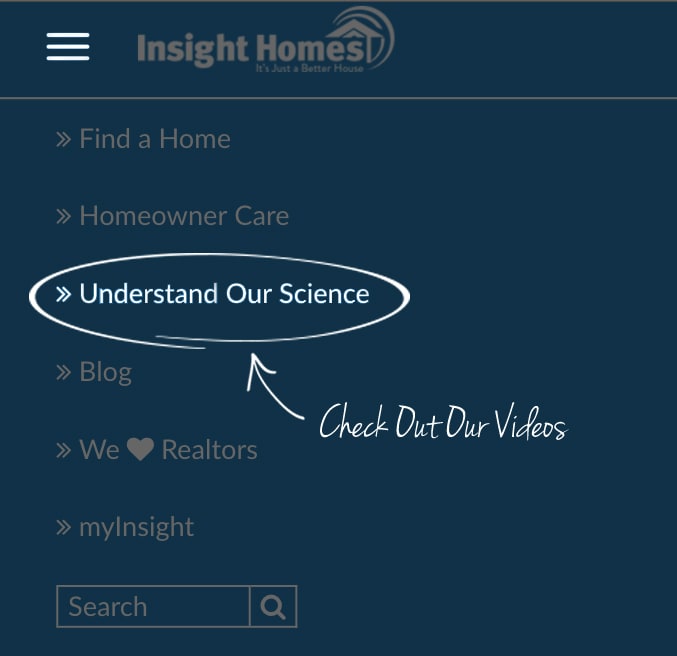

Swipe to learn more