High interest rates have prompted many buyers to pause, especially those considering relocating to Delaware from higher-cost states like New Jersey or New York. We understand that hesitation. When rates rise, it feels responsible to wait. On the surface, holding off seems to be the safer financial move.

But what often goes unnoticed is the quiet cost of waiting. While rates grab the headlines, everyday expenses continue to drain your finances month after month. Rent, taxes, utilities and daily living costs do not pause while you wait. They add up quickly, and unlike a mortgage payment, they do not build equity or offer a future return on investment.

For buyers considering a move to Delaware, the real question is not just about interest rates. It is about whether waiting is actually costing you more than acting now.

Think You’re Saving by Waiting? Think Again.

We speak with buyers every day who feel stuck. They are ready for a change but unsure if now is the right time. Interest rates feel like a barrier, so they stay put and hope conditions improve.

What many do not realize is that waiting often comes with permanent losses. Every month spent paying high rent, elevated property taxes or inefficient energy bills is money gone for good. These costs do not disappear later. They cannot be recovered or refinanced.

This is where perspective matters. Waiting might feel cautious, but when you look at the whole picture, it can quietly work against your long-term financial goals.

What Are Unrecoupable Expenses?

Unrecoupable expenses are costs you incur that cannot be recovered. Rent is the most obvious example. Once it is paid, it is gone. The same is true for excessive property taxes, inflated utility bills and higher everyday living costs.

Unlike a mortgage payment, these expenses do not build equity. They do not increase your net worth. They simply support your current situation without improving your future position.

Many buyers focus solely on the interest rate, but that rate is temporary. Unrecoupable expenses are ongoing. Waiting for the perfect rate can mean spending thousands more on costs that offer no return.

How Living in Delaware Can Save You Money Every Month

One of the most significant financial advantages of moving to Delaware is the substantial reduction in monthly expenses compared to many neighboring states. These savings often outweigh the impact of a higher interest rate.

Property taxes are significantly lower in Delaware compared to New Jersey or New York. For many buyers, the difference can exceed $1,000 per month. That kind of savings feels like an instant raise and can dramatically change your monthly budget.

Sales tax is another major factor. Delaware has no sales tax, which means everyday purchases cost less. Over the course of a month, those savings can easily reach several hundred dollars without any lifestyle change.

Energy costs are often overlooked, but they are one of the fastest-rising expenses for homeowners. Older homes usually waste energy due to inefficient systems and inadequate insulation. New, high-performance homes dramatically reduce monthly utility bills, helping protect you from rising energy prices.

Additionally, the general cost of living in Delaware is lower. Groceries, dining, gas and entertainment all tend to cost less. When combined, these monthly savings can total over $1,500. Over the course of a year, that amounts to approximately $20,000 that stays in your pocket.

The Hidden Costs of Staying Put

When you wait, you are not avoiding costs. You are choosing which costs to pay. High rent, high taxes and inefficient energy use continue whether rates fall or not.

The difference is that these expenses are permanent losses. A mortgage rate can be refinanced. Rent checks cannot. Utility bills from inefficient homes do not come back to you later. The time spent waiting also delays equity growth and the lifestyle improvements you have been planning for.

You can always refinance a mortgage. You can never recover the money lost while waiting.

Why Insight Homes Is the Smartest Way to Save Big

Where you live matters, but how your home performs matters just as much. We design our homes to reduce total ownership costs from the start, not just the purchase price.

Every Insight Home is built to meet or exceed Zero Energy Ready Home standards. That means lower utility bills, healthier indoor air and more predictable monthly expenses. Our homes achieve exceptionally low HERS scores, helping protect homeowners from rising electricity costs that continue year after year.

We also believe in transparency. We show real energy performance data so buyers can see exactly how much they can save. By engineering efficiency into every home, we help turn monthly savings into long-term financial stability without sacrificing comfort or design.

Stop Waiting and Start Building a Better Future

Waiting for interest rates to drop may feel safe, but it often comes at a much higher cost than expected. While you wait, unrecoupable expenses continue to grow. That money could be going toward equity, experiences and a lifestyle that better fits your goals.

For many buyers, moving to Delaware is not just a relocation; it's a lifestyle change. It is a financial reset. Lower monthly costs, energy-efficient homes and long-term savings create flexibility and peace of mind that waiting cannot provide.

You don’t have to figure this out alone. Contact Insight Homes today and let us show you how moving now, not later, could be the smartest financial decision you make all year.

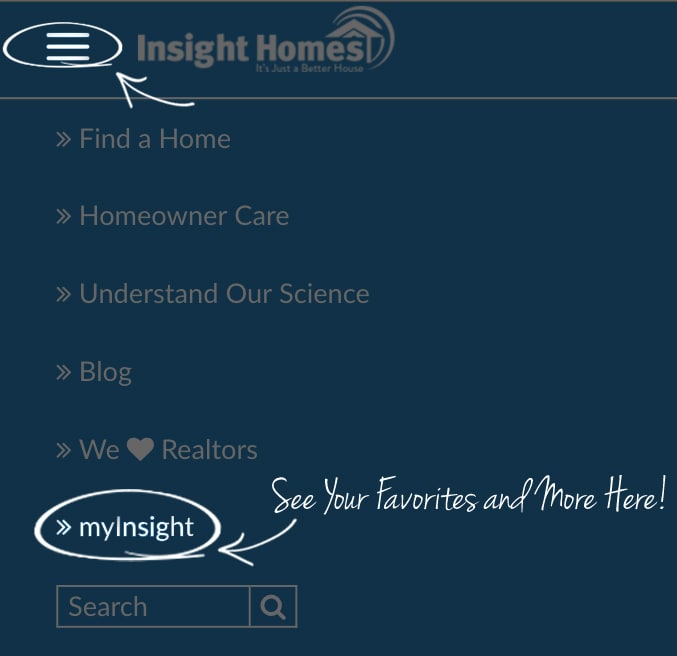

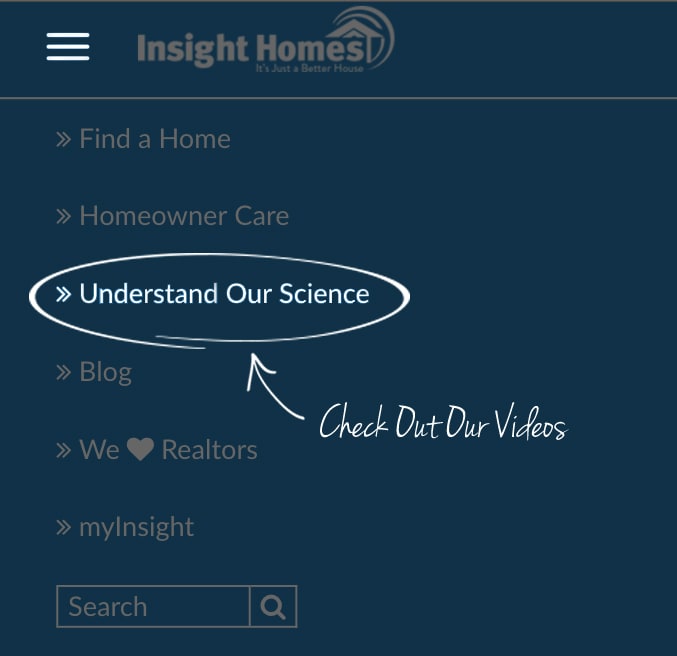

Swipe to learn more

Swipe to learn more